* – This article has been archived and is no longer updated by our editorial team –

Apis Capital Management is a US based hedge fund manager, specializing in algorithmic, market neutral trading with a specific focus on trading volatility in the US stock market through options and futures. Below is our recent interview with Edgar Radjabli, Managing Partner at Apis Capital Management:

Q: Could you tell us something more about Apis Capital Management?

A: Established in 2015, we currently manage over $5MM (million) in assets for investors through our unique volatility trading strategy, which has returned over 70% annually since inception. Our firm was founded by experts in securities and option trading, with over 20+ years experience.

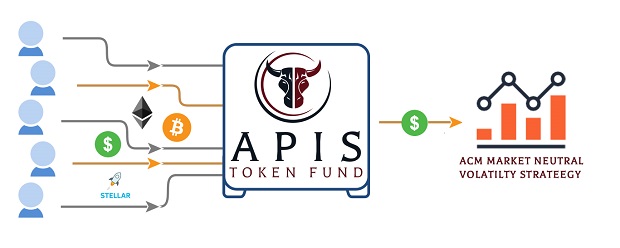

Q: What are the advantages of Apis Token Fund?

A: The advantages of the Apis Token Fund are:

1. Proven Track Record: the Apis Token is a direct investment in the proven strategy that has been successfully implemented by Apis Capital over the last 29 months and has returned 211% since inception

2. Unique Diversified Strategy: Using algorithmic trading, the Apis token benefits from a strategy focused on stock market volatility and its derivatives, enabling it to profit in sideways, down or up markets. The strategy does not invest in the stock market or the crypto market, and has virtually zero correlation to the overall stock market of the price of bitcoin, providing an excellent diversification opportunity for investors.

3.Instant Liquidity: Apis Tokens are built on the powerful and robust Stellar protocol, and are tradeable from day one on the Stellar decentralized exchange

4.No Minimum Investment or Management Fees: Unlike traditional hedge funds with high barriers to entry and high yearly fees, the Apis Token model benefits investors with no minimums or ongoing fees, resulting in much higher total returns.

5. Tax Deferment for US Investors: Whereas limited partner (investors) in traditional hedge funds pay tax every year, token investors only pay tax when they sell the token, benefiting from tax free appreciation of their investment. For a typical US investor, combined with no management fees, this could result in as high as 700% higher return over 10 years by investing in the Apis Token compared to the same strategy in a typical hedge fund.

Recommended: Soma Creates A Trading Platform That Will Unite Social Interactions And Trading In A Single Platform

Recommended: Soma Creates A Trading Platform That Will Unite Social Interactions And Trading In A Single Platform

Q: What about the risks associated with short volatility?

A: As with any investment, there is no reward without risk. Many current ICO tokens or projects have potential upside but can just as easily go to zero as they are oftened abandoned completely. Similarly, there is some risk involved in trading volatility. The are notable examples where the volatility of the US stock market exploded in a single day, such as August 24, 2015 and February 5th, 2018. It’s a cautionary tale that a strategy that is simply shorting volatility all the time is bound to have significant losses. Over 10 years of market experience has enabled the team at Apis to quantify, analyze and predict volatility patterns to implement risk measures. We use in depth market analysis, proprietary trading signals and indicators to successfully anticipate large scale changes in the volatility landscape. As a result, we were able to avoid both large volatility explosions, which left other short volatility traders exposed or ruined. In addition to our strategy, we also implement strict risk management via position sizing, ensuring that we don’t overexpose ourselves to volatility events even if our trading signals were to fail. This provides a dual layer protection for investors.

Q: Why did you choose to base your platform on Stellar?

A: Stellar is the ideal choice for issuing asset-backed tokens. It is one of the top cryptocurrency protocols, backed by IBM and having an over $5 billion market cap. It is over 100 times more robust than ERC-20 (allowing a maximum of 1000 TPS vs 7 TPS) and transactions settle nearly instantly. It provides a decentralized exchange, ensuring token holders benefit are able to access liquidity for their investments without having to “wait” for the big centralized exchange to “allow” trading of the Token.

Lastly, Stellar is actually the most user friendly protocol for those new to cryptocurrency. You can create an account and receive Apis Tokens in less than 5 minutes, without downloading any software or registering with a specialized wallet service. Stellar’s built in wallet/exchange have built in security because it is always decentralized and be default supports hardware wallets such as Ledger Nano S, ensuring users do not need to manually input their secret keys.

Recommended: IVN Cryptography Develops The Most Advanced Security Technologies: IVN Cryptography, IVN Captcha, And IVN VPN

Recommended: IVN Cryptography Develops The Most Advanced Security Technologies: IVN Cryptography, IVN Captcha, And IVN VPN

Q: What is on the roadmap for Apis Capital Management moving forward?

A: We have launched on June 1st on the Stellar network. We have raised $1.7 million in the initial pre-sale, and we have issued those tokens to the initial investors, and the funds raised are already deployed, potentially earning profits in June. We are continuing our token sale on a monthly basis, clients investing in June will be issued tokens at the end of the month and the funds deployed in July. This is an “ongoing ICO” model that allows continuous investment in the fund. We are also partnering with the White Company, as we will be the inaugural Asset Manager on their White Company Capital platform, which will allow clients to invest in a variety of asset managers representing strategies ranging from volatility trading, securities, real estate and others. While our ongoing ICO model allows investment on a monthly basis, we have a hardcap of $50 million and early investors benefit from a discounted price on the token as well as earlier access to potential profits.