Below is our recent interview with Matt Osborn. Matt Osborn is the Director of Marketing at Apruve, a Fintech company that is revolutionizing how businesses buy from each other.

Q: For those who haven’t heard of it, what is the best way to describe Apruve?

A: Apruve is the simplest way to extend net terms to customers. By making it easy to extend credit and ensuring you get paid immediately without risk, Apruve drives increased sales, improves customer buying experiences, and makes A/R obsolete.

Only Apruve makes every aspect of extending terms simple, friction-free, and paperless — for both the buyer and seller.

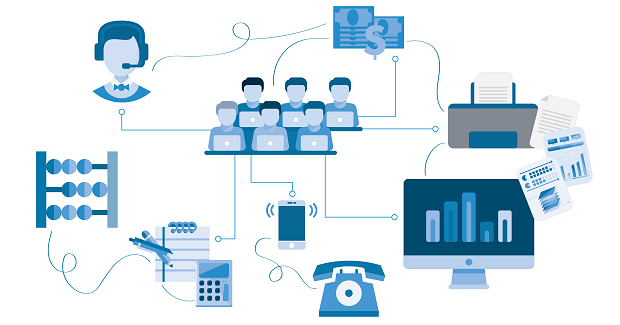

It works in the background, connecting multiple lenders, who deliver credit to your customers, at any point of sale. The solution is easy to plug into any accounting, ERP or eCommerce platform, eliminating duplicate work.

Hundreds of B2B merchants use Apruve to run healthier, happier businesses.

Recommended: Meet The Passionate Team Behind The Hit Word Puzzle Game Pictoword

Recommended: Meet The Passionate Team Behind The Hit Word Puzzle Game Pictoword

Q: What are the benefits of automating B2B credit program?

A: Extending credit to your business customers comes with an enormous amount of work, costs, and Risk.

By automating the process with Apruve, businesses can focus on what they do best – creating a superior product and/or service to their buyer. No longer do businesses need to worry about when or how their customers will pay or increasing overhead to manage invoices and credit approvals.

With Apruve, it is simple. Extend the terms your buyers are asking for without any of the negatives that typically go with extending credit.

Q: What are some of the specific use cases or scenarios you can share on how business can leverage Apruve?

A: Over 50% of business transactions are done over some form of net terms. Extending terms to your business buyers are used as a sales tool to drive order frequency and order volume.

On average, we see companies have 2.2 the order frequency and 3.3 the line items of a transaction done over a credit card.

By not offering terms to your business buyers, not only are you possibly missing out on more frequent and larger orders, but you may also be losing opportunities to a competitor that does extend terms.

Q: What makes Apruve the most convenient purchasing, invoicing and payment solution?

A: What makes Apruve so convenient is the fact that many businesses have separate processes or software for how business purchases, how they are invoiced, and how they pay their suppliers. After a business invests heavily in all these areas, they are still left with a receivable on their balance sheet and still exposed to financial risk.

With Apruve, buyers can purchase seamlessly online or offline through whatever process they currently order from, be sent their invoices and look up their invoices from our portal, and pay their outstanding invoices from the same portal. At that same time, the supplier is paid 24 hours after invoicing, making Apruve more streamlined for the buyer and seller while eliminating cash flow concerns and risks from the sale.

Recommended: Meet Quppy – A Unique Solution For Purchasing, Selling, Storing And Managing Your Crypto And Fiat Assets

Recommended: Meet Quppy – A Unique Solution For Purchasing, Selling, Storing And Managing Your Crypto And Fiat Assets

Q: What is crucial to the success of an online store?

A: At Apruve, we have launched a lot of b2b eCommerce reports. No matter the industry, the same problems persist.

Businesses either look to make a B2C feeling website and completely ignore the needs of a business buyer, or think of the needs of a business buyer and completely ignore the user experience of B2C.

In order to succeed in B2B eCommerce, businesses need to give the buyer the look and functionality of a B2C experience that they are used to in their personal lives(Offering mobile-friendly site, easy navigation, standard pricing available to everyone, reviews, etc.).

On top of that, they need to add features specific to B2B buying, but adapting and streamlining them for B2B (Account based and volume pricing, payment terms, partial shipments, bundled search, etc.)

Lastly, B2B storefronts need to understand that eCommerce does only simplify the buying process for their current buyers but it is also a tool to drive customer acquisition. To drive growth companies must focus on SEO, SEM, and quick account setup or allow for guest checkout.