Below is our recent interview with Fran Goerlich, Chief Operating Officer at ClearCycle Corporation:

Q: For those who haven’t heard of it, what is the best way to describe ClearCycle Corporation?

A: ClearCycle Corporation is a Disbursement Management Organization helping every business in maximizing their cashflow while simplifying their Financial Operations. We help businesses in improving their operational efficiency and lowering disbursement cost while enhancing financial control across all lines of business and geographies.

We help the Healthcare industry in enhancing their provider relations and member experience through our unified claims disbursement process while simplifying their financial reconciliation.

Since 1983, we have been providing payment solutions to a wide cross-section of major American companies in Healthcare, Insurance, Retail, Manufacturing, and Logistics. ClearCycle has been an innovator in helping customers to manage and resolve their most complex financial payment processes. We understand that our customers need solutions that improve their administrative efficiency, create costs savings and provide market insights that allow them to do business better. For over 3 decades, ClearCycle has consistently fulfilled the challenge of providing effective, money-saving cash management systems.

Our Vision is to be the leader in Financial and Disbursement Management in each industry niche, helping our customers in keeping pace with technological advances financial management and in maximizing their financial returns through innovation and competence; with passion, integrity and quality.

Q: What makes you a leading provider of corporate finance and disbursement systems?

A: We are not just a payment and disbursement solution like so may payment solutions out there in the market. We are a business to business enterprise payment disbursement solutions provider that integrates corporate finances, lines of business, vendors and all other stakeholders in the disbursement process to simplify the process and reduce the operating cost of enterprise wide payment disbursement. The key to our success lies in the relationship that we build with our customers and continuously work with them in building operational excellence. Some of the areas where we beat our competition and are a key ingredient for our customer retention are –

- Financial Control Over Disbursement Processing

- An Enterprise Disbursement System that Handles All Upstream Processing Platforms

- Regulatory/Contract Compliance (payment rules, interest, surcharge)

- Payment Cost Reduction (aggregation, EFT, adjustment automation)

- Cash Flow Improvement (larger investment pool)

- Better Output Information (paper, electronic, and web-based provider and subscriber payment information)

- Overpayment Recovery (within business rules defined by management)

- “Prospective” Audit Controls (applied post-adjudication but pre-payment)

- Extensive EFT/835 payment capabilities that increase electronic commerce

- Rapid Response to Disbursement Requirements (at a fraction of their previous cost of internal IT development)

Q: Why do we need to transform financial and disbursement management processes?

A: Financial technology and processes are rapidly changing. Just look at how the world has changed from traditional check payment to payment modes like Apple Pay, Google Pay, and so on. From depositing a check using mobile apps to performing an international money transfer in minutes, Financial Technology (Fintech) is going through a rapid digital transformation. This rapid change is not only changing the technology, but also changing the entire process of financial transaction and services. Along with the emerging technologies such as Cloud and cognitive computing, if you add blockchain to the mix, it will further accelerate this trend. While these technology changes are transforming the style of financial and disbursement management, new laws and regulations, security, and Government mandates are also changing the way we do business. So unless organizations transform their financial and disbursement processes to align with this new era of digital transformation, they will struggle to remain competitive in the market. But this transformation of finance and disbursement is not an easy task. It needs clear goal setting, careful planning, strategic execution and seamless integration that encompasses both legacy and modern applications.

At ClearCycle, we partner with our customers in their financial and disbursement management transformation and ensure that they achieve:

- Highest degree of Return on Investment

- Least amount of time for Initial Investment Payback

- Operational Cost Savings

- Cost Reductions

- Operational Efficiencies

- Regulatory Compliance

With more than 3 decades of experience in Finance, Accounting, and Cash Flow systems and services, ClearCycle is the perfect blend of business expertise and technical knowledge. We’ve been helping our esteemed customers in all industry segments through our wide range of professional and implementation services such as –

- Financial Business Process Optimization

- Financial Advisory Services

- Financial Control and Accounting

- Financial Business Intelligence

- Billing Process Management

- Financial Systems Implementation

Q: Can you explain the different products ClearCycle is creating and what they do?

A: ClearCycle offers two primary products, ValuPay and UCDS (Universal Claims Disbursement System), along with host of other supporting applications and tools.

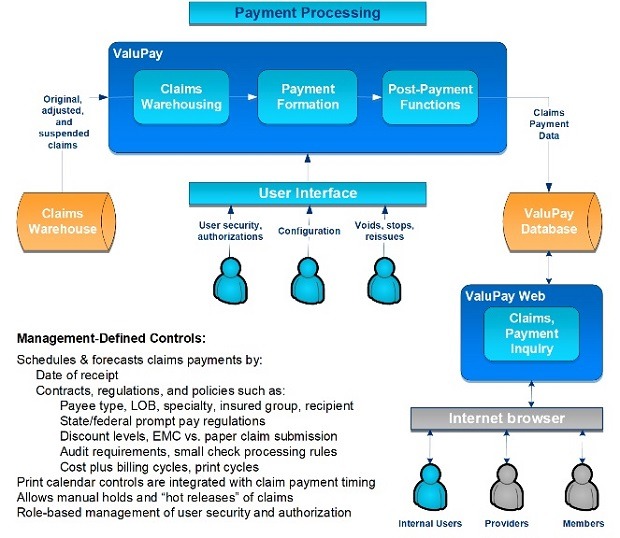

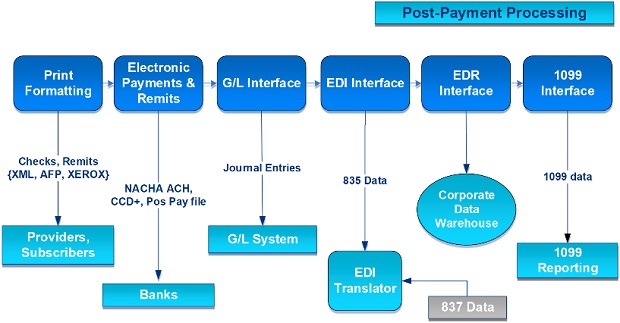

ValuPay is a comprehensive payment disbursement system that works in conjunction with any core business system such as Vendor Management, Claims Adjudication, Broker, Provider, Medicare, Premium Billing and any other Payroll or ERP systems. It accepts payment data and all types of claims, capitation and commission records from all lines of business, across all platforms, business entities and computing environments. More than a simple payment system, ValuPay controls cash flow and consolidates payments, remittance advices and EOBs according to user-defined business rules. The system supports compliance with HIPAA and other government regulations including late payment interest and surcharge taxes. Focused towards the Corporate, Commercial and Healthcare business, ValuPay is a powerful database driven application giving management the ability to orchestrate all payment functions across the enterprise to effectively meet its objectives. It incorporates the ability to process all types of payments (that is, vendor payments, payroll, exception checks, claims payment, Broker commission, and so on) using traditional paper and electronic methods. This richly featured software system written for Windows provides comprehensive on-demand information, security delegation, rapid integration, and custom form design, along with other innovations making ValuPay the best solution for today and a bridge to the future.

Recommended: Online Family Jeweler Allurez Launches Full Line Of Men’s Fashion Rings

Recommended: Online Family Jeweler Allurez Launches Full Line Of Men’s Fashion Rings

UCDS (Universal Claims Disbursement System) is a comprehensive claims payment disbursement system. UCDS accepts payment data and medical event records from all lines of service, across all platforms, business entities, and computing environments. UCDS controls cash flow, consolidates payments, remittance advices and EOBs according to business rules associated with the data source. UCDS normalizes all payment transactions from multiple claims systems, broker systems, etc. and reduce Mailing and Check issuance costs by 40%. It provides complete automation of all types of payment adjustments (pre- and post-payment) and enable precise payment scheduling to ensure compliance and great customer service. It has provisions to systematically recover overpaid claims compliant with all 50-state regulatory requirements. It handles CDH (consumer directed healthcare) and ASO (cost plus); billing, funds fetch, customer reporting, stop loss control and provides easy integration to and support of all sub-systems (that is, EFT, G/L, reconciliation, 1099, escheat, and so on.)

Recommended: Quiq Raises 12.5M In Series B To Help Companies Orchestrate Commerce And Service Conversations

Recommended: Quiq Raises 12.5M In Series B To Help Companies Orchestrate Commerce And Service Conversations

In addition, we provide WebUCDS (“web portals”) as a stand-alone, web-based product that interfaces with UCDS along with both Member and Provider portals. The data accessed by WebUCDS originates in the UCDS application and is the source for data returned by ClearCycle’s web services.

With more than 200 installations of our products and financial tools in fortune 500 companies, we are the pioneer in financial solutions.

Q: What would you say was the single most influential factor in your business success?

A: With more than 30 years of experience in finance and disbursement, the most influential factor in our business success is our ability to adapt to both the technical and regulatory changes to finance and disbursement management and to enable our customer to stay ahead of the competition in both technology and regulatory compliance. Above all, the ability of our product and services to accept changes to all surrounding client systems or new systems with no to very minimal impact distinguishes us from our competition.

Q: What are your plans for the future?

A: At ClearCycle, we are consistently working on improving our products and services to meet the latest market trends, advancement in technology and latest regulatory compliances. While we continue to work on expanding our product and services relevant to the market needs, we are also working on adopting emerging technologies. Our immediate plan is to offer our products as Software as a Service in cloud platform. We are in the middle of testing phase for our cloud-based service offering. Through our cloud-based offering, we plan to expand our services to cater to all sizes of customers and all types of disbursement needs.

We are also working on our long-term plan for our products and services in the Healthcare space. Finance and disbursement management in healthcare is challenged not only by the changing technology, but also by the need for innovative reimbursement models. The traditional reimbursement models will slowly disappear and will be replaced by new age disruptive reimbursement models that will benefit Patient, Providers and Payers. We are keeping a close watch on all such developments and our healthcare experts are working on updating our platform to embrace these upcoming changes. Our goal is to become a change enabler in healthcare finance and disbursement.