Below is our recent interview with Alex Lofton, Co-Founder and Head of Growth at Landed:

Q: Alex, can you tell us something more about Landed?

A: Landed is on a mission to help essential professionals – starting with educators – build financial security near the communities they serve, so that they can commit to their communities and classrooms. We do this primarily by investing alongside teachers and school staff when they are ready to buy a home. Instead of providing a loan with interest, Landed provides educators with half of a standard down payment in exchange for part of the appreciation gain or loss when the home is sold. So far, Landed has helped hundreds of people into homes worth more than $100 million in the metro areas of Denver, San Francisco, Seattle, San Diego, and Los Angeles. We also provide a trusted network of agents, homebuying education, and financial coaching.

Q: Why did you choose to help educators afford homes in the communities in which they teach?

A: Our team at Landed is passionate about helping educators put down roots in their communities and classrooms. Personally, I know firsthand how difficult it is to come up with a down payment for a home on a teacher’s salary. My mom was a 4th grade teacher in Bellevue, WA and my father was a social worker. Growing up, we weren’t able to own a home until my grandmother passed away and left us her house, the first example of intergenerational wealth being transferred for my family. At Landed, we’re hell-bent on providing increased access and expanded home ownership options to the dedicated school teachers, college faculty, and staff who uphold our communities every day.

Recommended: Syncoria Provides Consulting, Design, Implementation, Customization, And Training Services On Business Software

Recommended: Syncoria Provides Consulting, Design, Implementation, Customization, And Training Services On Business Software

Q: You’ve recently announced $7.5m in Series A round; could you tell us something more?

A: This funding round was led by Initialized Capital, who has deep expertise in creating some of the most successful brands on the modern web and scaling transformative companies, such as Reddit.

We’re thrilled to have Intialized’s support to accelerate our work to help more educators put down roots in their communities and classrooms. This funding will drive growth of our operating business, allowing us to provide even more school teachers, college faculty, and staff with critical down payment support to buy a home.

Q: How do you help educators buy homes in expensive areas?

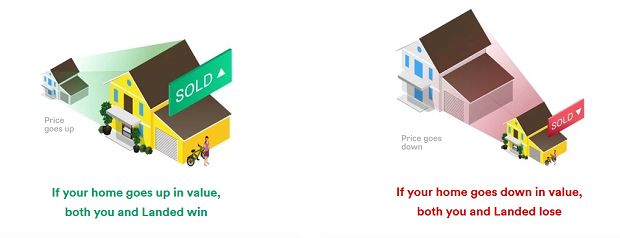

A: We’ve found that many school employees and their families are able to afford the monthly payment on an 80% mortgage. But when they’re spending thousands of dollars on rent each month, saving for a 20% down payment – which is essentially required in expensive markets – seems impossible. Landed offers an alternative: we help educators step onto the homeownership ladder by paying for half of their down payment in exchange for a portion of the appreciation (or depreciation) on the home.

This down payment support can help make homeownership less risky and costly for the people we work with. Landed reduces that down payment amount by half, and lenders typically look at the down payment the same way they would if a homebuyer put the whole 20% down themselves. This means our homebuyers can avoid paying Private Mortgage Insurance (PMI). Since Landed is not a lender and doesn’t make loans, the people we work with don’t need to pay Landed anything until they sell or refinance their home during the 30-year term. We share in the ups and downs of the home’s value over time, and if someone needs to sell when the market is down, Landed will share in the loss.

More information about how it works can be found here.

For individuals and families who aren’t yet ready to buy a home – or for whom our down payment support is not the right fit – we offer financial coaching and homebuying education, and we connect educators with other programs in the communities where we work. We know we’re just one tool in the toolkit working on this problem, and part of what we’re excited about is building that network of community support for our essential professionals.

Recommended: Jace McDonald Working To Stop Identity Thief’s And Protect Business Owners And Their Families

Recommended: Jace McDonald Working To Stop Identity Thief’s And Protect Business Owners And Their Families

Q: You’re also offering financial wellness education to your clients – what exactly does it cover?

A: In addition to down payment support, Landed provides teachers, faculty, administration, and school staff with free financial coaching calls, events, and resources. We provide in-person and over-the-phone experiences to help the people we work with fully understand what they are getting into with homeownership and what that journey is going to look like. That way, if they aren’t ready today, they can start planning to get out of debt and save to become a homeowner in the future.

Q: What are your plans for the future?

A: With this recent fundraising round, we’re poised to expand our reach to help educators in over a dozen markets by the end of 2019, including Austin, Boston, and Honolulu. And we recently expanded into higher education, with Bellevue College being our first partner in that space. We look forward to working with more colleges and universities soon.

Last Updated on July 7, 2019